LOGO Applications provide opportunity to work with different legislations. In the event of using Fixed Asset Management program in International sets, the Depreciation Tables are taken according to the legislation of the country that user works with.

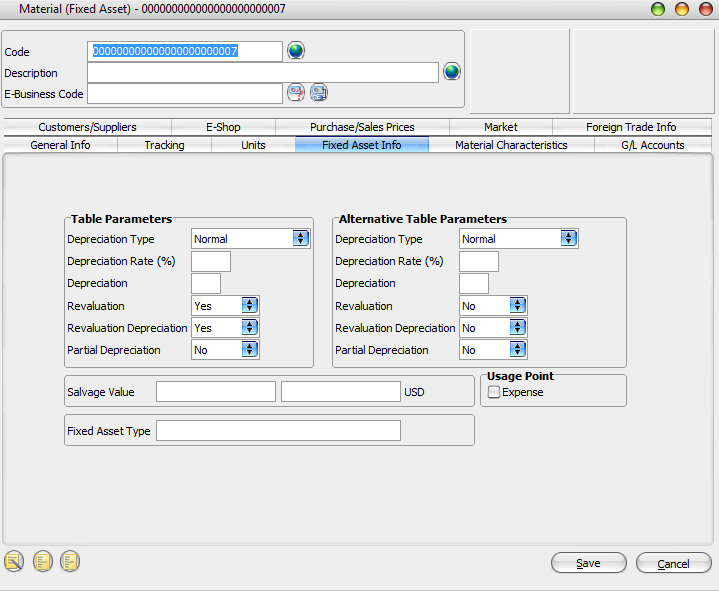

Depreciation table parameters for fixed assets are recorded by the fields in the following parts located in fixed asset definition window.

- Table-Accounting Parameters

- Table-Tax Parameters

In Depreciation field, elapsed time is specified starting from depreciation separation over fixed asset till the completion of depreciation separation.

Depreciation tables are prepared in a yearly basis and display the depreciation applied to fixed assets, revaluations and other related information. Depreciation and revaluation tables function in connection with fixed asset records. In addition to values recorded on the table record window, the alternative parameter values are also obtained. Depreciation and revaluation tables are generated using the following options on the fixed asset records list:

- Depreciation Table (Accounting Legislation)

- Depreciation Table (Tax Legislation)